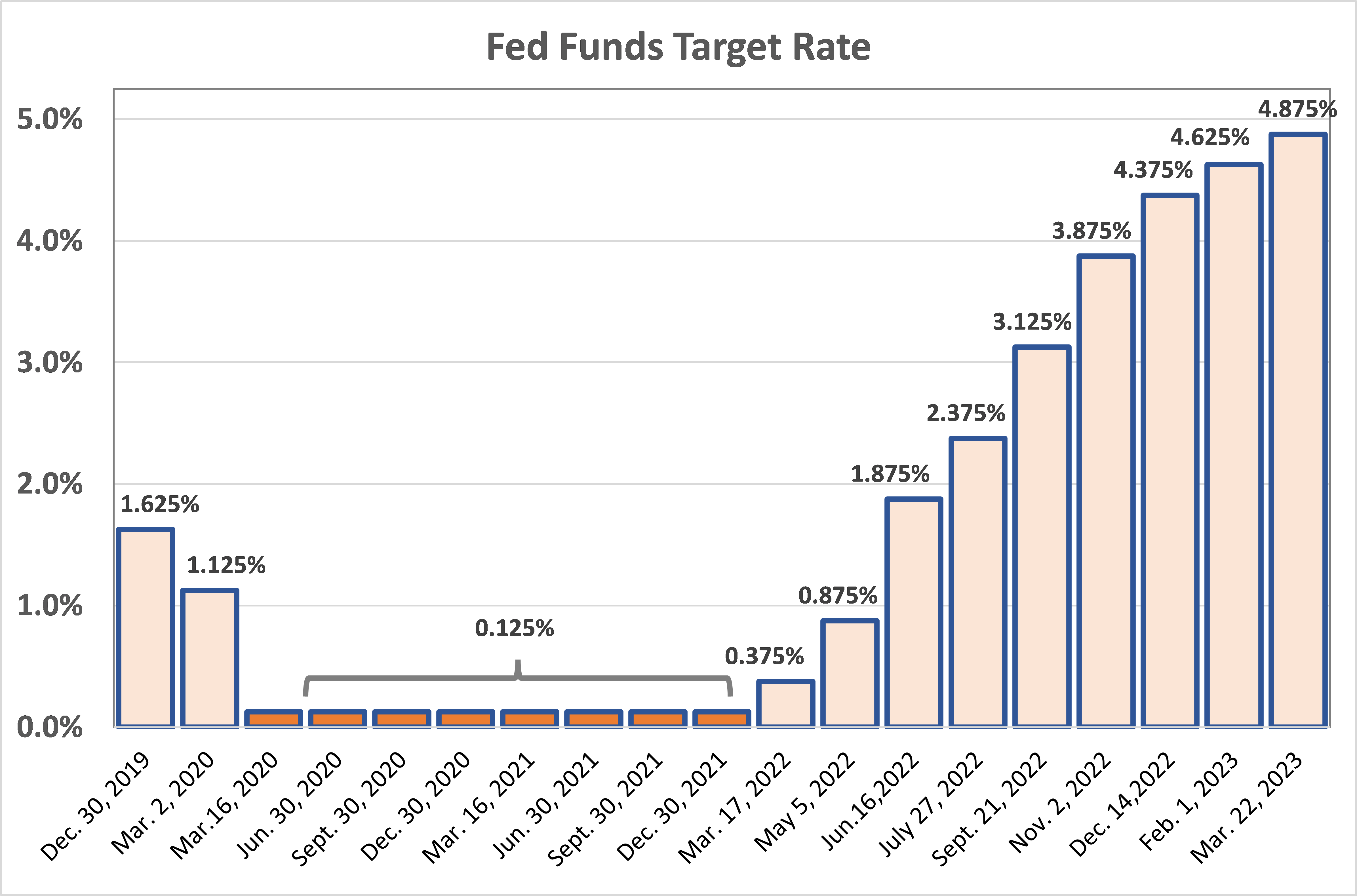

Interest Rate Decisions: Federal Reserve Interest Rates

:max_bytes(150000):strip_icc()/ScreenShot2022-05-05at3.10.47PM-9401c217a6554ef38045747660cefed5.png)

The Federal Reserve, the central bank of the United States, is responsible for setting interest rates. Interest rates are the prices charged for borrowing money. The Fed sets interest rates to achieve its dual mandate of price stability and maximum employment.

The Fed’s interest rate decisions are made by its policy-making body, the Federal Open Market Committee (FOMC). The FOMC meets eight times a year to discuss the economy and set interest rates. The FOMC’s decisions are based on a variety of economic data, including inflation, unemployment, and economic growth.

Factors Influencing Interest Rate Decisions

The Fed considers a number of factors when making interest rate decisions, including:

- Inflation: The Fed’s goal is to keep inflation low and stable. If inflation is too high, the Fed may raise interest rates to slow down economic growth and reduce inflationary pressures.

- Unemployment: The Fed also wants to keep unemployment low. If unemployment is too high, the Fed may lower interest rates to stimulate economic growth and create jobs.

- Economic growth: The Fed wants to keep the economy growing at a moderate pace. If the economy is growing too slowly, the Fed may lower interest rates to stimulate growth. If the economy is growing too quickly, the Fed may raise interest rates to slow down growth.

Economic Impact of Interest Rates

Federal reserve interest rates – Interest rates are a fundamental tool of monetary policy, influencing economic growth, inflation, and unemployment. By adjusting interest rates, central banks can steer the economy towards desired outcomes.

Higher interest rates generally slow economic growth. Businesses and consumers borrow less, reducing spending and investment. This dampens demand, which can help curb inflation. However, it can also lead to slower job creation and higher unemployment.

Businesses and Interest Rates

- Higher interest rates increase borrowing costs for businesses, making it more expensive to invest in new equipment, hire workers, or expand operations.

- Lower interest rates make borrowing cheaper, encouraging businesses to invest and hire, boosting economic growth.

Consumers and Interest Rates

- Higher interest rates make it more expensive for consumers to borrow money for cars, homes, or other purchases.

- Lower interest rates make borrowing cheaper, increasing consumer spending and stimulating economic activity.

The Liquidity Trap

In some cases, very low interest rates can create a “liquidity trap.” When interest rates are near zero, monetary policy becomes less effective in stimulating the economy.

“When interest rates are at or near zero, conventional monetary policy loses much of its traction.” – Ben Bernanke

In a liquidity trap, businesses and consumers may be reluctant to borrow even at low interest rates, leading to economic stagnation.

Market Implications of Interest Rates

Interest rates play a crucial role in shaping the financial markets. They influence the behavior of investors, traders, and financial institutions, and can have significant implications for asset prices, market volatility, and economic growth.

Impact on Stocks

Generally, higher interest rates tend to have a negative impact on stock prices. This is because higher interest rates make it more expensive for companies to borrow money and invest in their businesses. This, in turn, can lead to slower earnings growth and lower stock valuations.

Conversely, lower interest rates can boost stock prices by making it cheaper for companies to borrow and invest. This can lead to higher earnings growth and increased investor confidence, driving up stock prices.

Impact on Bonds

Interest rates have a direct impact on bond prices. When interest rates rise, bond prices fall, and vice versa. This is because bonds are essentially loans that investors make to companies or governments. As interest rates rise, investors can get higher returns on new bonds, making existing bonds less attractive and driving down their prices.

Conversely, when interest rates fall, investors are less likely to sell their existing bonds, which increases demand and drives up prices.

Impact on Currencies

Interest rates can also influence currency exchange rates. When a country raises its interest rates, it makes its currency more attractive to investors seeking higher returns. This increased demand for the currency can lead to its appreciation against other currencies.

Conversely, when a country lowers its interest rates, it makes its currency less attractive to investors, which can lead to its depreciation.

Anticipating and Reacting to Interest Rate Changes

Investors and traders closely monitor interest rate changes and anticipate their potential impact on financial markets. They use a variety of tools and techniques, such as economic data analysis, technical analysis, and sentiment analysis, to try to predict future interest rate movements.

When interest rates are expected to rise, investors may sell stocks and bonds and move their money into cash or other safe-haven assets. Conversely, when interest rates are expected to fall, investors may buy stocks and bonds in anticipation of higher returns.

Risks and Opportunities, Federal reserve interest rates

Interest rate fluctuations can present both risks and opportunities for investors. The key is to understand the potential impact of interest rate changes on different asset classes and to adjust their portfolios accordingly.

For example, investors who are heavily invested in bonds may face risks if interest rates rise unexpectedly. On the other hand, investors who are invested in stocks may benefit from rising interest rates if they believe that companies will be able to pass on the higher costs to consumers and maintain their profit margins.

Understanding the market implications of interest rates is essential for investors and traders who want to make informed decisions and navigate the financial markets effectively.

The Federal Reserve’s recent interest rate hike has sparked concerns among economists. While the move was widely anticipated, its potential impact on the economy remains uncertain. Amidst this uncertainty, the news of Steve Klauke’s passing has cast a somber shadow over the financial community.

Klauke, a renowned economist and former Fed official, was a respected voice in the debate surrounding interest rate policy. As the Fed continues to navigate the complexities of the current economic landscape, his absence will be deeply felt.

The Federal Reserve’s interest rate decisions have far-reaching implications, not only for the economy but also for the financial markets. Solomon Choi’s 16 handles strategy is one way to navigate the complexities of these decisions, as it provides a framework for understanding how interest rates affect different asset classes.

By understanding the relationship between interest rates and market behavior, investors can make informed decisions about their portfolios and mitigate potential risks.

The Federal Reserve’s recent interest rate hike has sparked discussions about its potential impact on global economies. Meanwhile, on the sporting front, the upcoming USA vs. India cricket series is generating excitement among fans worldwide. As the global financial landscape adjusts to the changing interest rate environment, the outcome of this highly anticipated cricketing clash remains uncertain, adding to the intrigue surrounding both the financial and sporting arenas.

The Federal Reserve’s interest rate decisions have far-reaching effects, impacting economies worldwide. For instance, a recent rate hike has sparked debates on its potential implications for emerging markets like Brazil and Mexico. Brazil vs Mexico is a particularly relevant comparison, as both countries have significant exposure to global financial markets and rely heavily on commodity exports.

As the Federal Reserve continues to adjust its monetary policy, it will be crucial to monitor its impact on the economic dynamics between these two emerging market powerhouses.

The Federal Reserve’s recent interest rate hikes have sent shockwaves through the financial markets, but their impact extends far beyond Wall Street. In a remote coastal town, a tragic incident has brought the consequences of rising rates into sharp focus.

A woman, swallowed by treacherous quicksand, fought desperately for her life , a poignant reminder that economic policies have far-reaching effects on individuals and communities alike. As the Federal Reserve continues to grapple with inflation, it must also consider the human toll of its decisions.